Bond Refund Rules: What Landlords Can Deduct For Cleaning

When tenants leave a rental house; one of their main concerns is whether their bond will be returned. Landlords and property managers have the legal authority to deduct money from the bond if the property is not left in the same condition as when the tenancy began; allowing for reasonable wear and tear. However, there are strict rules on what can and cannot be deducted, especially when it comes to cleaning.

Understanding the bond return rules might help tenants avoid unnecessary disputes and ensure a simpler moving out process. This article will cover what landlords can deduct for cleaning and how to prepare. Understanding your obligations and what landlords look for during quality bond cleaning Port Macquarie inspections will help you avoid unexpected deductions.

Hide

Show

- Understanding Bond Refunds and Cleaning Obligations

- What Counts as Fair Wear and Tear vs. Negligence

- Common Cleaning Costs Landlords Deduct

- How Tenants Can Avoid Cleaning Deductions

- Resolving Cleaning Disputes with Your Landlord

- Professional Cleaning Clauses in Lease Agreements

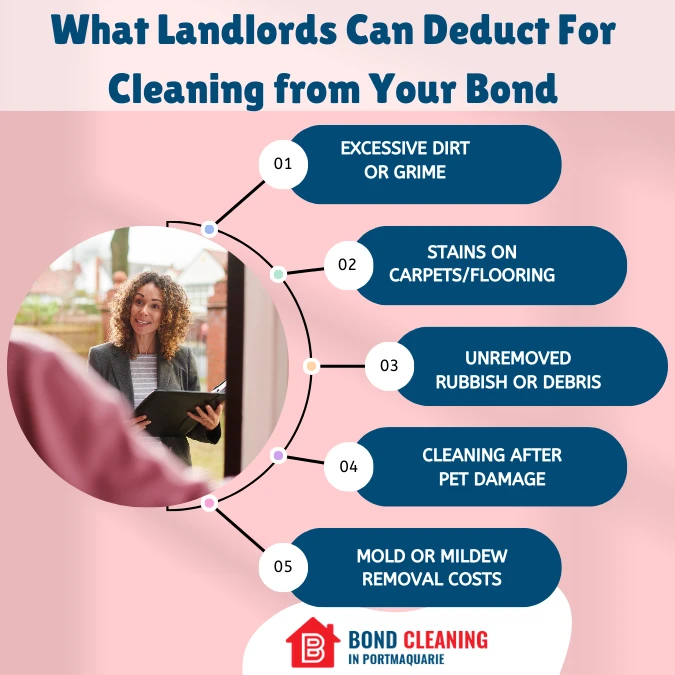

- Infographic: What Landlords Can Deduct For Cleaning from Your Bond

- Wrapping Up

1. Understanding Bond Refunds and Cleaning Obligations

A bond, also known as a security deposit, acts as financial protection for landlords in case tenants cause damage, fail to pay rent, or leave the property in poor condition. At the end of a lease, the landlord has the right to request deductions from the bond if the property requires cleaning beyond reasonable wear and tear.

Cleaning obligations are one of the most common reasons for bond disputes. Tenants are expected to return the property to the same cleanliness standard it was provided at the beginning of the lease. This means everything from carpets and windows to bathrooms and kitchen, must be properly cleaned before handing over the keys.

2. What Counts as Fair Wear and Tear vs. Negligence

It’s very importrant, to understand the distinction between normal wear and tear and tenant carelessness. Fair wear and tear refers to the natural deterioration of a property caused by routine use such as fading paint, worn carpet from everyday foot activity or minor scuff marks on walls. Landlords cannot legitimately deduct the bond money for these issues.

On the other side; carelessness or poor maintenance, can result in valid bond deductions. Stains on carpets, grease buildup in the kitchen, mould from lack of ventilation, or dirty bathrooms fall under the tenant’s responsibility. Knowing the difference might help you realise what cleaning expenses can be deducted.

3. Common Cleaning Costs Landlords Deduct

Landlords usually deduct cleaning fees for specific problem areas in a property. Kitchens and bathrooms are the most common areas where tenants fall short, as grease, grime, and soap scum build up quickly. If things are not adequately cleaned, the landlord may engage professionals and deduct the fees from the bond.

Carpet cleaning is another frequent deduction. Many lease agreements require that carpets be professionally cleaned, especially if pets used to live on the property. Additionally, landlords may charge for dirty windows, dusty blinds, stained walls, and trash left behind. The goal is to fix these issues before moving out.

4. How Tenants Can Avoid Cleaning Deductions

The greatest approach, to prevent cleaning deductions is to plan ahead of time and keep the home pristine. Begin by reviewing your original entry condition report and comparing it to the property’s current state. Use this as a reference, to determine which areas require more attention. A thorough cleaning checklist for kitchen, bathrooms, carpets and outdoor places can be really useful.

For tenants in regional areas, engaging professionals like bond cleaning Port Macquarie services can help make the process go more smoothly. These specialists understand the exact standards that property managers require and can help ensure that no detail is ignored. While it incurs an additional cost at first, obtaining a bond refund usually saves tenants money in the long run.

5. Resolving Cleaning Disputes with Your Landlord

Even after a thorough cleaning; tenants and landlords may disagree about the property’s cleanliness. In these situations; tenants should attempt to fix the issue directly, with the landlord or property manager by giving documentation such as photos or receipts for professional cleaning services.

If an agreement cannot be reached, tenants can escalate the matter to the relevant tenancy tribunal in their state. These impartial authorities consider evidence from both parties and reach a legally binding decision. You can better protect your bond from unjustified cleaning deductions by being aware of your rights and keeping proper paperwork.

6. Professional Cleaning Clauses in Lease Agreements

Many tenancy agreements require tenants to employ professional cleaners at the end of their lease. These clauses usually include carpets, deep cleaning if pets have been present. If tenants fail to follow these terms; landlords have the authority to deduct the cost from their bond.

Understanding these clauses is critical since they establish the cleaning expectations up front. Before moving out tenants should carefully check their agreement and make arrangements for any necessary services. Hiring specialists for bond cleaning Port Macquarie not only fulfils contractual responsibilities, but also offers invoices as evidence in case of a disagreement; guaranteeing tenants are better protected when claiming their bond.

Infographic: What Landlords Can Deduct For Cleaning from Your Bond

Wrapping Up

Bond refunds can be a source of stress for tenants, but understanding the rules surrounding cleaning deductions makes the process much simpler. By differentiating between fair wear and tear and tenant negligence, addressing common problem areas and considering professional help like bond cleaning, tenants can maximise their chances of a refund.